ERROR #5: LACK OF A BUSINESS PLAN.

A business plan? For trading?

Of course. Same as if you want to open a restaurant, your trading career should be a project, planned and respected in order for us to survive in the markets. Sticking to it, is what differenciates the winners from the losers. Having a business plan is a MUST for any consistant profitable trader.

I would like to devote the last top-5 error to our inner trader. After having talked about how important is to have a profitable and tested strategy that works for us, that may not work in the same way for others, it’s fair to say that if the same strategy works for X but doesn’t work for Y, then the difference in the equation is X or Y. Therefore, there is something inside the person that makes us winners or losers, no matters what proven strategy we are using for trading.

Leverage is a double edge sword that can kill our accounts. We can open 0.01 trades but also 10 lots trades. There is nothing but our available margin stopping us. We see everyday those Instagramers showing their insane profits, their Lamborghini, their luxury life… wake up, that is not true. Brokers sponsor them to capture more clients, showing demo accounts as if they were real. I can asure you this is true.

Your BUSINESS PLAN is UNIQUE

Those who know me, understand this point perfectly, since our system is totally different for each one of us. We study the same concepts, we have the same instruments in our toolbox, but we all use them in a different way.

What is a business plan in trading?

Our business plan in trading is a set of parametes that define a series of unbreakable rules which will protect to our account, allowing us to monitor our strategy and performance.

What shoud be included in our trading plan?

It should have, at least, these 5 parameters:

CAPITAL: The most important difference between you and any other trader. It is totally different to start a trading account with 2000$ or 25000$.

MAX % RISK PER MONTH: This parameter is key for a healthy business. It should always be between 5% and 10%. You should also set a Max % risk per week by dividing it by 4. I wouldn’t advise to set a daily % risk, since market conditions can hit us one day and we need tobe smart enough to know if you can still trade until your weekly % is reached.

MAX RISK PER TRADE: Here we need to consider two factors. Your MaxPainLevel, which is the amount you are willing to lose without feeling absolutely nothing at all (learn more in this video) and a general rule that you need to apply for a correct money management, which is never risk more that 0.5% per trade.

OPEN TRADE MANAGEMENT: Here you have to decide what will you do when if a trade goes against you (partial loss) and when it goes to your favour (partial profit). This is very important and protects your account enormously.

MINIMUM TRADE VOLUME: It will depend on your strategy. In our system, we will always open a minimum of 0.02. The reason is that with 0.01 we cannot follow the Trade Management rules that we set in the previous point.

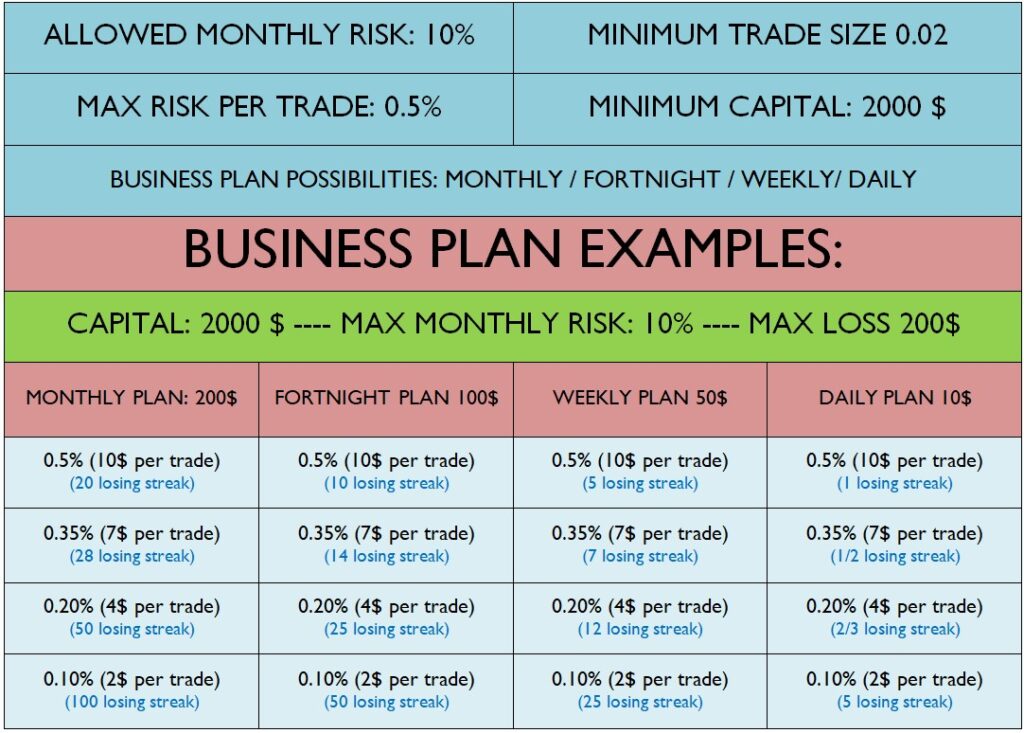

TWO EXAMPLES OF BUSINESS PLAN:

Above is a Business plan for a 2000$ trading account. I stated in blue, depending on the Max Risk per Trade, how many trades you need to lose in a row without winning any trade to consider your month/fortnight/week/day over.

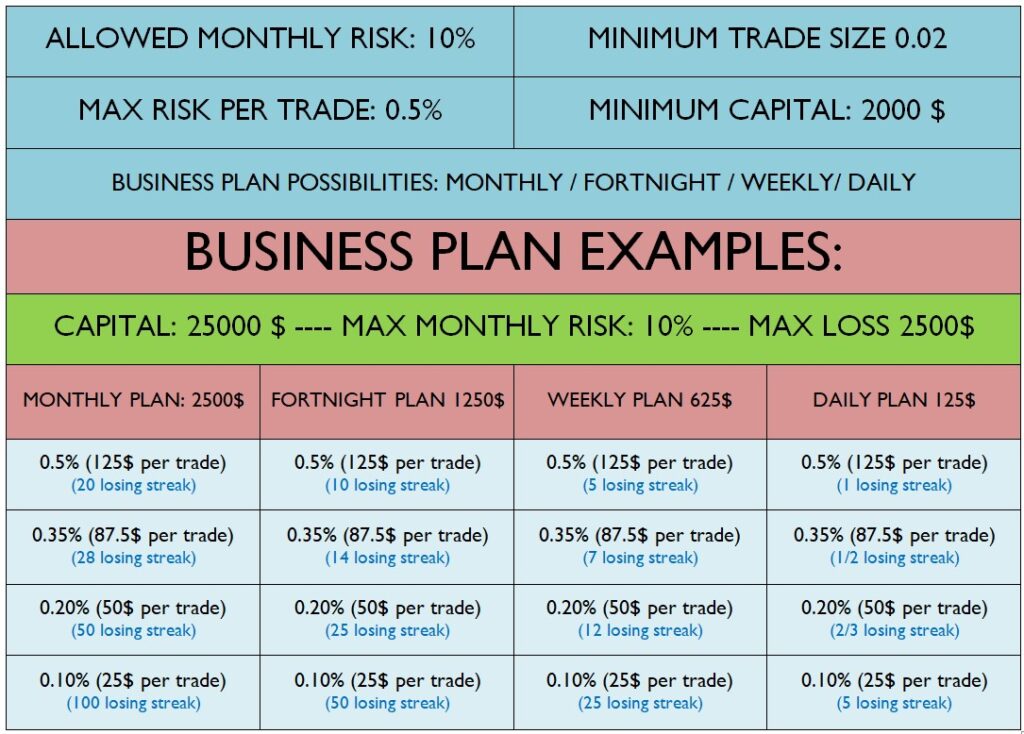

Let’s check another one. This time, the capital is 25000$. Check the differences.

As you can see, the difference in the Trading Plan is not the amount of trades we can afford to lose. The difference is how much the trader can lose per trade.

There is a last paramenter we need to consider. It is the distance to your stop. Remember we said that minimum trade size for us is 0.02, so that we can manage our trade taking partial profits or losses. Well, depending on the distance to your stop in a certain trade, you will realize if you can open it or not. As a general rule, 100 pips x 0.01 (microlot) will be around 1% in a 800$ account. We advise to start trading live with a minimum 1600$ account for that reason. This factor may change depending on your strategy.

After these Top 5 Errors and solutions shared in our Free Educative section we are proud to say we tried help traders avoid them, flattening their learning curve. Unfortunately, the trading career has more than 5 errors and even having understood everything, sometimes human seems to prefer learning things in the hard way. We really hope that is not your case.

Remember we have years of experience building profitable traders, if you want our advise feel free to contact @Chusssss or @chuslaptop in Telegram and we will try to help you build your own trading plan.

In case you want to learn to trade the markets with us, remember our next edition of the ATA Course will start in July 2022, you can book your seat now by registering in the website, once the enrolment starts, we will send an email to inform you about it. We love privacy, so we will never share your email with any company, or spam you with emails. In fact, we don’t have any subscriber or newsletter option, so ensure to read our Telegram channel to be updated regarding new posts.

Thanks for all the support. Have a great week!